- Earthquake Insurance

- Motorcycle

- RV Insurance

- Antique/Collector Vehicles

- Personal Articles Coverage

- (Umbrella) Excess Liability Coverage

- Flood Insurance

- Boatowners/Yacht/Personal Watercraft Insurance

- Wedding Insurance

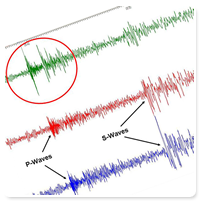

Earthquake

Insurance

Earthquake

Insurance

Earthquake insurance may be necessary in California because earthquakes are a fact of life. Many homeowners and commercial insurance policies exclude the peril of earthquake damage and earthquake sprinkler leakage. To avoid financial aftershock it would be wise to consider purchasing earthquake coverage for your property. Please contact our office for more information or to obtain a quote.

Motorcycle

Motorcycle

When you hit the open road on your motorcycle the

last thing you want to worry about is the right insurance coverage. Any motorcycle that is registered for street use is typically not covered under your automobile or homeowners policy. Our specialized motorcycle policies provide outstanding standard and optional coverage, including coverage for accessories, safety-related gear and much more.

RV Insurance

RV Insurance

An RV is like a vacation house on wheels, so it makes sense to protect your investment from top to bottom. With RV insurance, you can select all sorts of coverage, including Vacation Liability, Full

Timer’s, Emergency

Expense and much more. Your RV insurance policy also provides

coverage for your traveling companions and your valuables when you’re on

a trip.

Antique/Collector Vehicles

Antique/Collector Vehicles

Collectors

are turning to Surdez Insurance Services to protect antiques, muscle

cars, classic cars and newer exotics, street rods and customs, even kit

cars.

Some other coverage options are

- Harder-to-place autos with high horsepower

- Restorations in process

- Collector trucks

- Classic and custom motorcycles

- Trailers

- Race cars

- Military vehicles, tractors and fire engines

Personal Articles

Coverage

Personal Articles

Coverage

Your homeowners policy

provides limited coverage for certain classes of personal property.

Jewelry, guns, rugs, furs, antiques/fine arts and silverware, to name a

few. If you have individual items or collections that exceed these

special limits, you may not be adequately covered.

A

Personal Articles Floater can cover these special items. This policy can

also be used to cover valuable collections such as wine or sports

memorabilia. Please contact our office for more information or to obtain

a quote.

(Umbrella) Excess Liability Coverage

(Umbrella) Excess Liability Coverage

Sometimes the liability

limits on your homeowners or auto insurance policy may not be sufficient to cover the large court judgments being awarded these days. Also, there

may be some types of losses that standard auto and homeowners policies are not intended to cover. An umbrella policy may pick up these gaps and

can provide the additional coverage needed to protect you and your family.

Anyone can be sued, regardless of their

wealth or income level. In today’s litigious society people are

recognizing the need for additional liability coverage above their

homeowners and auto insurance policy limits. Policies are typically issued

at $1 million or $2 million limits, but higher limits are also available.

Please contact our office for more information or to obtain a quote.

Flood Insurance

Flood Insurance

Flooding is the nation’s number one natural disaster. While floods occur in every area of the country, many property owners remain unprepared. Only flood insurance protects your home and your belongings from damage caused by rising water or mudflow. Flood insurance pays covered claims even if a federal disaster is not declared. Your home does not necessarily have to be beach front to be susceptible to a flood. Each year, 35% of all paid flood claims are for properties located outside of high-risk areas. Please contact our office for more information or to obtain a quote.

Boatowners /

Yacht / Personal Watercraft Insurance

Boatowners /

Yacht / Personal Watercraft Insurance

When you take to the water, insurance for your

watercraft is as important as the lives on board. Many homeowners policies offer limited or no coverage for physical damage to or liability claims arising from use of a boat/yacht. If you have made the investment to own and operate a watercraft you’ll want to make sure your asset and its passengers are well protected. Below are some coverage options

available:

- Liability

- Physical Damage

- Uninsured Boat Coverage

- Medical Payments

- Towing and Assistance

Policies are available for small boats (under 26’) or yachts (26’ and over) as well as jet skis, sailboats, and houseboats. Please contact our office for more information or to obtain a quote.

Wedding

Insurance

Wedding

Insurance

Why

Wedding Insurance? Ever had a sleepless night, worry about what could go wrong? Unfortunately, some of what you’ve imagined can happen. A bride’s most common “nightmare” is usually dress-related…it’s damaged or defective, or the bridal salon goes out of

business. Severe weather can wash out your big day or a sudden illness can postpone the event. These are just some of the risks

for one of the biggest investments you’ll ever make (the average U.S. wedding is $27,000). You’d protect your car, why not your wedding?

No Dress

You can get repair or replacement cost if the bride’s wedding gown or groom’s tuxedo is lost or damaged.

Lost Deposits

We can reimburse your deposit if a vendor goes out of business, declares bankruptcy before your wedding, or simply fails to show up.

Lost Rings

You can receive repair or replacement cost if the bride’s or groom’s wedding band

is lost or damaged

Severe Weather

If severe weather (such as a hurricane) forces you to postpone your wedding,

this type of insurance can provide reimbursement for non-recoverable

expenses.

Transportation

Shutdown

If you have to postpone your wedding because a

commercial transportation shutdown prevents the bride or groom or their

parents from getting there, you can receive reimbursement for

non-recoverable expenses.

Ruined Photos

If your photographer’s film is defective, or negatives are lost or damaged,

wedding insurance can help reconvene your wedding party to take new

photos or video.

Call to Duty

If the bride or groom is unexpectedly called up to duty, or her or his

military or service leave is revoked forcing you to postpone the event,

we can provide reimbursement for non-recoverable expenses.

Venue Requires

Insurance

As an additional option to your policy, you can add

liability coverage to protect yourself in case a guest is injured or

causes damage to property.

Sudden Illness

If

the wedding needs to be rescheduled because sudden illness prevents the

bride, groom or their parents from attending, you can receive

reimbursement for non-recoverable expenses.

Additional

Expense

If a vendor suddenly becomes unavailable for your

event, but you can find a last minute replacement, this type of insurance

would provide coverage for your reimbursement expenses.